what is the max i can contribute to 457, 401k and roth ira combined

Contents

- 1 Does Roth IRA count towards 401k limit?

- one.one Does IRA count towards 401k limit?

- 1.1.one Can you contribute to a 401K and an IRA?

- one.1.two Can you max out 401K and IRA in aforementioned yr?

- 1.1.3 Does IRA count confronting 401K limit?

- ane.two Are Roth IRA limits divide from 401k limits?

- 1.2.one Are 401k and IRA contribution limits separate?

- 1.2.2 Are Roth and traditional 401k limits combined?

- i.ii.three Are 401k and Roth 401k limits separate?

- one.one Does IRA count towards 401k limit?

- 2 What is the max I can contribute to my 401k?

- 3 What is the average 401K past age?

- 3.i Where should my 401K exist past age?

- 3.i.1 How much should I have in my 401k at 40?

- 3.1.2 How much should I have in my 401k at threescore years quondam?

- iii.1.3 At what age should you be a 401k Millionaire?

- 3.2 What is a good 401K balance at age threescore?

- three.2.1 How much retirement should I have at 60?

- three.two.2 How much does the boilerplate 60 year old take in retirement savings?

- 3.ii.3 What is the average internet worth of a 60 twelvemonth onetime?

- 3.i Where should my 401K exist past age?

Does Roth IRA count towards 401k limit?

Yous make designated Roth contributions into a separate Roth business relationship from your 401 (k) plan. On the same discipline : June 6, 2021 – WOODTV.com. They are counting on the limit.

Can you have both a Roth IRA and a 401k? The quick answer is yes, you can have both a 401 (one thousand) and an individual retirement account (IRA) at the aforementioned time. … These plans share similarities in that they provide the opportunity for tax savings (and, in the case of the Roth 401 (k) or Roth IRA, also revenue enhancement-free income).

Does IRA count towards 401k limit?

Short Respond: Yes, you lot can contribute to both a 401 (k) and an IRA, simply if your income exceeds the IRS limits, you could lose out on ane of the tax benefits of the traditional IRA. To meet besides : What happens to taxes and payouts with an IRA in a trust?. How it works: One of the benefits of a traditional IRA is that you will receive a tax deduction each twelvemonth for your contributions.

Can you contribute to a 401K and an IRA?

Yes, you tin can have both accounts and brand a lot of people. The traditional individual pension account (IRA) and 401 (chiliad) offer the benefit of tax savings for retirement. Depending on your tax situation, y'all may as well be able to get a tax deduction for the amount you contribute to a 401 (chiliad) IRA each revenue enhancement year.

Can you lot max out 401K and IRA in same year?

The limit for 401 (one thousand) plan contributions and IRA contributions does non overlap. As a effect, yous tin can fully contribute to both types of plans in the aforementioned year as long as you meet the unlike requirements.

Does IRA count against 401K limit?

While covered nether a 401 (grand) plan at work can affect your ability to make deductible contributions to an IRA, your contributions practise not count confronting each other, nor does a rollover to an IRA count toward your contribution limit for the yr.

Are Roth IRA limits separate from 401k limits?

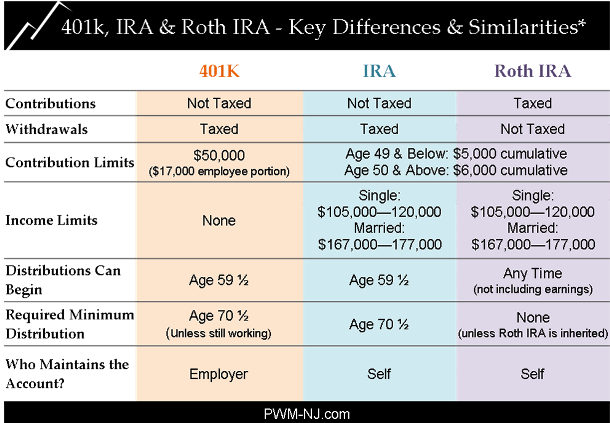

You tin contribute upwardly to $ nineteen,500 by 2020 to a 401 (k) plan. If you lot are fifty or older, the annual contribution jumps to a maximum of $ 26,000. Read also : Kingston: Understanding the 60-day rollover rule | Business. You tin can also contribute upward to $ 6,000 to a Roth IRA by 2020. That jumps to $ 7,000 if you are 50 or older.

Are 401k and IRA contribution limits separate?

Kickoff, understand the annual contribution limit for both accounts: 401 (m): Y'all can contribute up to $ 19,500 in 2021 and $ twenty,500 in 2022 ($ 26,000 in 2021 and $ 27,000 in 2022 for those 50 years or older). IRA: You can contribute upward to $ six,000 in 2021 and 2022 ($ 7,000 if age 50 or older).

Are Roth and traditional 401k limits combined?

This is a no-tax contribution, which means you can non deduct any contributions from your taxable income. Remember that the maximum contribution is an amass limit across all your 401 (thou) plans; You tin can non salve $ 19,500 in a traditional 401 (thou) and another $ nineteen,500 in a Roth 401 (k).

Are 401k and Roth 401k limits separate?

Although the contribution limits are the same for traditional 401 (1000) plans and their Roth counterparts, technically a designated Roth 401 (k) account is a dissever account within your traditional 401 (1000) that allows the contribution of afterwards-tax dollars. . .

To see too :

Maximizing social security benefits tin can become a long style to making your…

What is the max I tin can contribute to my 401k?

For 2021, your individual 401 (k) contribution limit is $ 19,500, or $ 26,000 if you are 50 years or older. By 2022, 401 (thousand) contribution limits for individuals are $ xx,500, or $ 27,000 if you lot are 50 or older. These individual limits are cumulative over 401 (thou) plans.

.

See the article :

In mid-March, President Joe Biden signed third incentive account by law, and…

What is the average 401K by age?

| AGE | Average 401K BALANCE | MEDIAN 401K BALANCE |

|---|---|---|

| 25-34 | $ 26,839 | $ 10,402 |

| 35-44 | $ 72,578 | $ 26,188 |

| 45-54 | $ 135,777 | $ 46,363 |

| 55-64 | $ 197,322 | $ 69,097 |

How much money does the boilerplate person take in their 401K when they retire? The average 401 (k) balance is $ 106,478, according to Vanguard's 2020 analysis of over v million plans. Merely about people take not saved so much for retirement. The median 401 (k) balance is $ 25,775, a ameliorate indicator of what Americans have saved for retirement.

Where should my 401K be by age?

This is how many Fidelity experts recommend that you lot salve for retirement at any age:

- Up to xxx years, you should have saved the equivalent of your salary.

- Up to 40 years, you should accept saved three times your salary.

- By historic period 50, you should take saved vi times your salary.

- Up to 60, you lot should have saved eight times your bacon.

How much should I have in my 401k at xl?

If your household income is closer to $ l,000, you should even so see a nice thirty% boost to your retirement savings if you consistently relieve xx% of your later-tax income. At historic period forty, you should really be closer to $ 500,000 or more in your 401k.

How much should I take in my 401k at 60 years old?

Fidelity says up to 60 years you lot should accept saved eight times your electric current bacon. So, if y'all earn $ 100,000 past then, your 401 (k) residuum should exist $ 800,000. How much money do you need to pay your bills each month?

At what historic period should you be a 401k Millionaire?

Recommended 401k Amount By Historic period Middle-aged savers (35-fifty) should be able to become 401k millionaires around 50 years of age if they have reached their 401k maximum and invested properly since the age of 23.

What is a skillful 401K balance at historic period 60?

The goal is for you to alive a good retirement life and not worry about coin. The above boilerplate 60 year former should accept at least $ 800,000 in their 401k if they have been diligently saving and investing. Nonetheless, the average threescore-year-one-time is closer to $ 170,000 in his or her 401k.

How much retirement should I have at 60?

Age fifty – 5 times almanac salary. Age 55 – six times annual salary. Historic period 60 – seven times almanac salary. Age 65 – eight times annual salary.

How much does the average 60 year former have in retirement savings?

When you reach the historic period of 60, you probably take retirement in listen. Have you saved enough? How much does the average threescore-year-old have to salve for retirement? According to Federal Reserve data, for 55- to 64-twelvemonth-olds, that number is trivial more than $ 408,000.

What is the average internet worth of a 60 year erstwhile?

According to Fed information, the median net worth for Americans in the belatedly 60s and early on 70s was $ 266,400. The average (or boilerplate) net worth for this age group is $ 1,217,700, but since the averages are higher due to households with high cyberspace worth, the median is a much more than representative amount.

Source: https://roth-ira.net/can-i-have-a-roth-ira-and-a-401k/

0 Response to "what is the max i can contribute to 457, 401k and roth ira combined"

Post a Comment